Advocacy and support for the Community Protection Act (CPA) were demonstrated by the attendance of over 160 advocates for green space, historic preservation, and affordable housing at a Boston City Council hearing to champion that the proposed measure be placed on the November ballot.

CPA is a smart growth tool designed to help cities and towns create affordable housing, preserve open space and historic sites, and develop outdoor recreational opportunities. CPA funds are generated by a small surcharge on local property tax bills matched by a statewide trust fund. Without enacting CPA, the state trust monies from Registry of Deeds filing fees will not be available funding for Boston.

The Friends is one organization in a coalition of more than 40 community-based parks, housing and preservation groups who think that the political climate is right for a vote. The coalition is recommending a one percent property tax surcharge, with exemptions for low-income homeowners, low- and- moderate- income senior homeowners and for the first $100,000 of residential and business’ property value.

The City of Boston would generate up to $20 million every year dedicated to CPA projects such as:

- Improving and developing parks, playgrounds, trails, and gardens

- Acquiring land to protect water quality and reduce climate change impacts

- Creating thousands of new, affordable homes for seniors, families and veterans

- Restoring and preserving historic buildings and rehabilitating underutilized historic resources

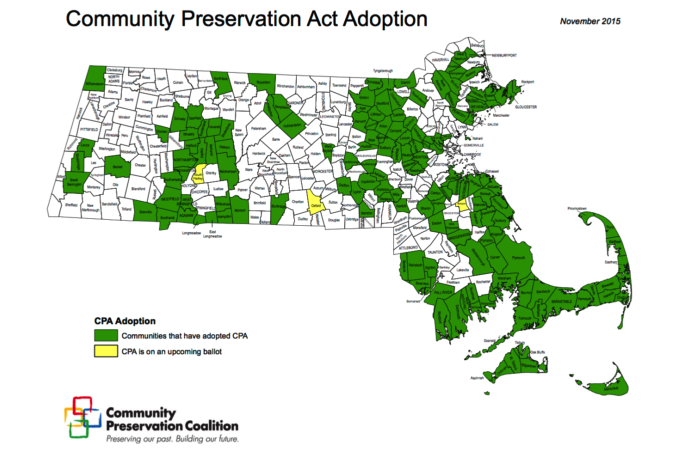

Since 2000, 160 Massachusetts communities have adopted CPA and have been able to take advantage of over $1.6 billion for over 8,100 projects. Cities that have adopted the CPA include Cambridge, Somerville, Fall River, Medford, and Waltham.

Join the Friends to mobilize support for the November ballot. We will keep you updated and you can learn more about Community Preservation Act here.